La novità più bella dei Pixel 10 è quella copiata da Apple

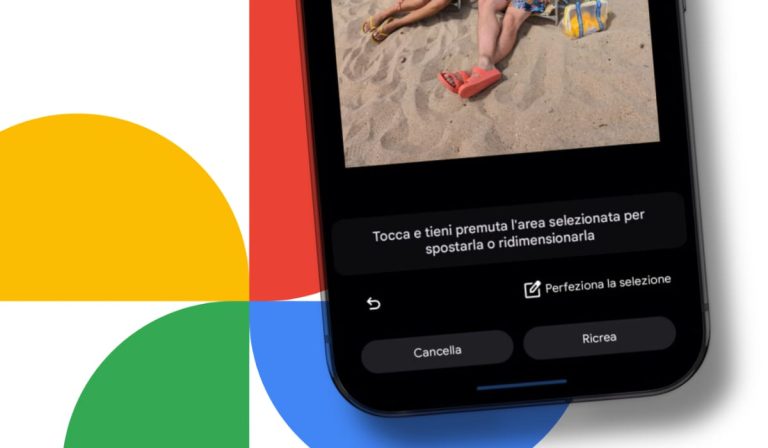

Google porta Qi2 e accessori magnetici sui nuovi Pixel 10: ecco come funziona PixelSnap, il sistema che sfida il MagSafe di Apple.L’articolo La novità più bella dei Pixel 10 è quella copiata da Apple sembra essere il primo su Smartworld.